Take payments using Invoice Payments

What are Invoice Payments?

Sage Invoice Payments is a great way for your customers to pay you online, quickly and easily.

Use Sage Invoice Payments to request payments from your customers, using the payment providers Stripe, PayPal, or GoCardless.

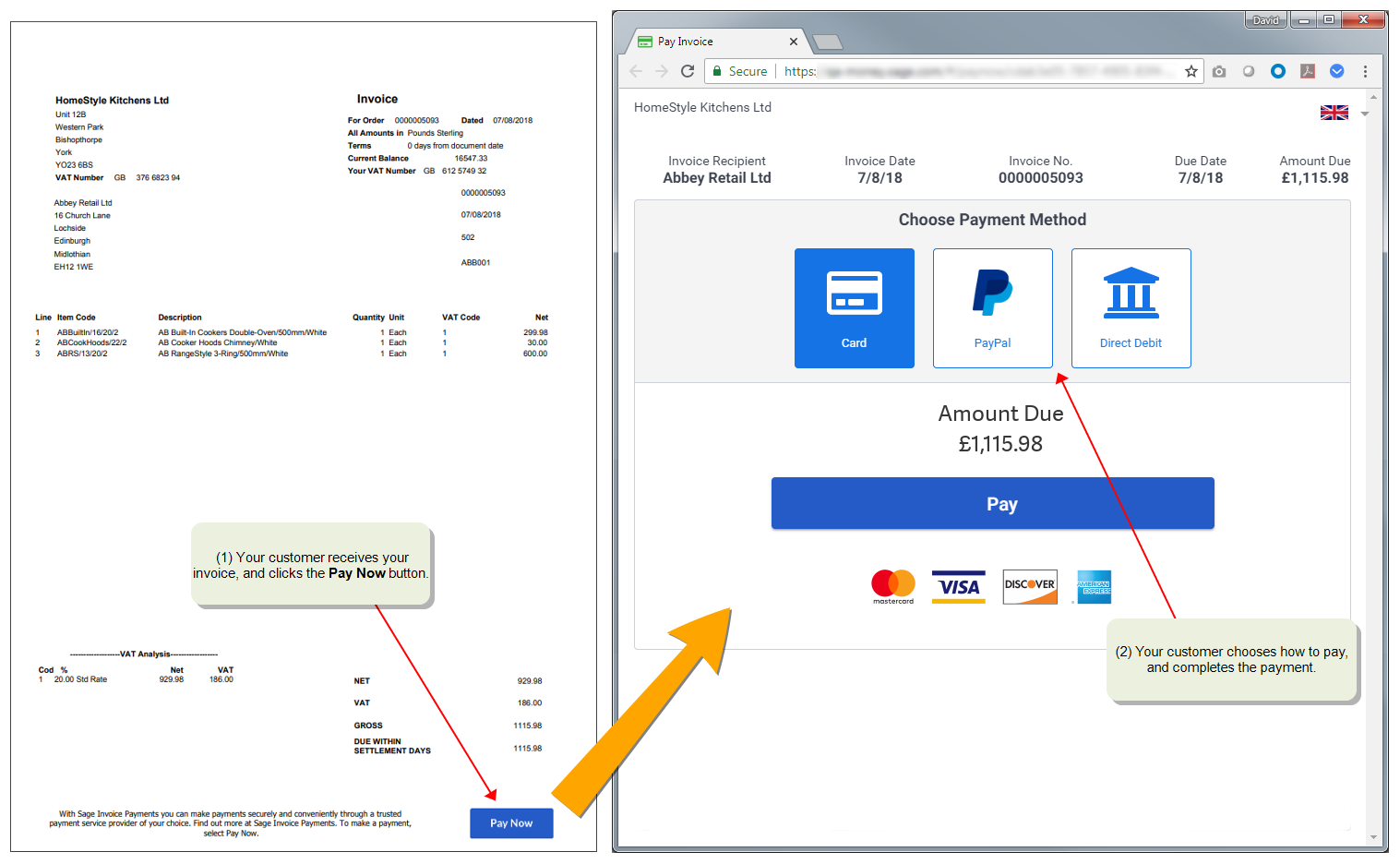

You generate invoices with a Pay Now button, then email the invoices to your customers. Your customers then select the Pay Now button to pay the invoice using the payment provider that you've chosen.

After your customer pays the invoice, the transactions can be downloaded and posted in Sage 200.

Invoice Payments integrates seamlessly with Sage 200, making it easier for your customers to pay you, and easier for you to process those payments.

Note: If you want to receive payments using Opayo (formerly Sage Pay) instead, see Take card payments using Opayo (formerly Sage Pay).

Note: The Invoice Payments service only works for invoices that you have emailed to your customers and have been paid using the Pay Now button. The service works with for invoices produced from Sales Order Processing or Invoicing, but not for invoices that you've manually entered for customers (Customers > Enter Transactions > Sales Invoice), and not for invoices that you've imported into Sage 200.

How it works

-

Set up Sage Invoice Payments in Sage 200 and choose the payment providers that you'll offer to your customers:

- Create and email an invoice to your customer using an Invoice Payments layout.

- When your customer receives the email, they click a Pay Now button on the invoice, and make the payment using one of the payment providers you've set up.

- Once the payment is received, Sage 200 will download the transactions and automatically make postings.

Get paid faster with Pay Now

We have provided email layouts for invoices that contain a Pay Now button for use with Invoice Payments. This means when your customer receives your invoice or statement, they can pay you straight away by clicking Pay Now.

The Pay now button contains a link that takes the customer to the Invoice Payments service. Your customer will see the amount due to pay, and can choose the payment provider (if you have set up more than one). Once your customer has paid the invoice, you can download the transaction Sage 200 and automatically allocate the payment to the invoice.

The Pay Now button is available on the following layouts.

| Layout type | Layout file name | Used for |

|---|---|---|

| SOPInvoice |

SOP Invoice Payment Service Provider (E-Mail) SOP Invoice Payment Service Provider (Email Plain Paper) |

Sales invoices, from both Invoicing or Sales Orders. |

Invoice Payments cannot be used with pro forma Invoices.

To set up layouts for Invoice Payments, see Send invoices with Invoice Payments (Pay Now).

What services can I use?

You can use the following payment providers:

-

Stripe, to receive payments from credit card and debit cards, bank transfer, Google Pay and Apple Pay.

-

PayPal, to receive PayPal payments.

Please note

-

Your Stripe or PayPal account must only be used for a single business or legal entity. For example, if your account has multiple wallets for different currencies, these must all be used for the same business.

-

A Sage 200 company database cannot be linked to more than one PayPal, Stripe or GoCardless account.

-

If your customer chooses to pay using GoCardless, the direct debit will be used for this and all their future invoice payments, and they will not be able to pay using Stripe or PayPal.

-

You can use your PayPal account before it is verified. For information on verification, see PayPal's article What does verified account status mean? (opens in a new tab).

-

If you already use Opayo (formerly Sage Pay) and then set up Invoice Payments, the Invoice Payments service will be used instead of Opayo. So when your customers click Pay Now on an invoice, they will complete the payment via Invoice Payments instead of Opayo.

How much does it cost?

There is no charge from Sage.

You will pay charges to your payment provider, which may be per transaction (PayPal, Stripe), or according to a payment plan (GoCardless).

To find out the fees charged by your provider, refer to their website:

- Stripe pricing (opens in a new tab).

- PayPal pricing (opens in a new tab).

- GoCardless pricing (opens in a new tab).

Sage is providing this article for organisations to use for general guidance. Sage works hard to ensure the information is correct at the time of publication and strives to keep all supplied information up-to-date and accurate, but makes no representations or warranties of any kind—express or implied—about the ongoing accuracy, reliability, suitability, or completeness of the information provided.

The information contained within this article is not intended to be a substitute for professional advice. Sage assumes no responsibility for any action taken on the basis of the article. Any reliance you place on the information contained within the article is at your own risk. In using the article, you agree that Sage is not liable for any loss or damage whatsoever, including without limitation, any direct, indirect, consequential or incidental loss or damage, arising out of, or in connection with, the use of this information.